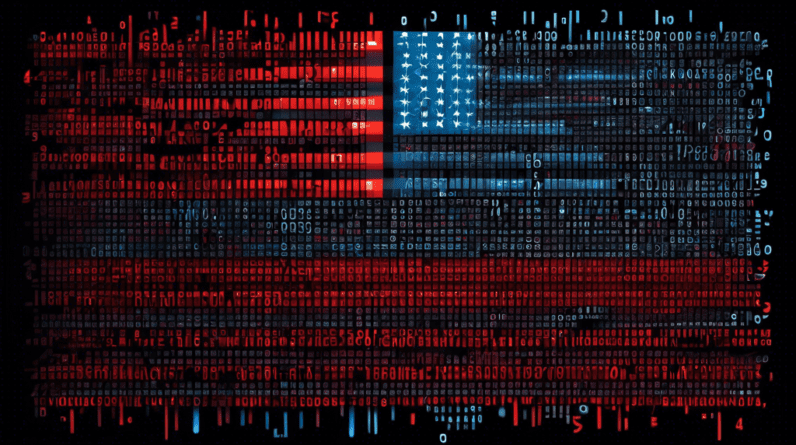

What Happened?

In a shocking incident that has sent ripples through the insurance industry, First American Financial Corporation, a leading provider of title insurance and settlement services, experienced a massive data breach. This breach, discovered in 2019 but only recently gaining widespread attention, exposed sensitive personal and financial information of thousands of customers.

The Extent of the Breach

The leaked data, which spanned several years, included a treasure trove of sensitive information, such as:

- Social Security numbers

- Bank account numbers

- Mortgage and tax records

- Driver’s license details

- Wire transfer receipts

- Escrow documents

This kind of information is highly valuable to cybercriminals and puts those affected at significant risk of identity theft, financial fraud, and other malicious activities.

How Did it Happen?

The breach reportedly stemmed from a design flaw in First American’s website application. This flaw allowed anyone with knowledge of the system’s URL structure to access and download documents without any authentication. A simple change in the URL string could grant access to confidential files, exposing the data of countless individuals.

This type of vulnerability, known as an insecure direct object reference (IDOR), highlights the importance of robust security measures and regular vulnerability assessments.

The Aftermath and Response

Upon discovering the breach, First American took steps to secure its systems and mitigate the damage. The company disabled the vulnerable application and launched an investigation to determine the scope of the incident. They also notified law enforcement and began notifying affected individuals.

However, the response has been met with criticism. Concerns have been raised about the delay in disclosure and the adequacy of communication with those affected. The incident has sparked investigations by regulators and fueled class-action lawsuits, leaving First American to grapple with significant legal and reputational damage.

Lessons Learned and the Importance of Cybersecurity

The First American data breach serves as a stark reminder of the critical importance of cybersecurity in today’s digital landscape. It highlights the vulnerability of even large, well-established companies and emphasizes the need for proactive security measures.

Here are some key takeaways from the incident:

1. Robust Security Measures are Essential

Companies must prioritize cybersecurity and implement robust security measures to protect sensitive data. This includes:

- Regular security assessments and penetration testing

- Strong password policies and multi-factor authentication

- Data encryption and secure storage practices

- Employee training on cybersecurity best practices

2. Timely Detection and Response are Critical

Early detection of security vulnerabilities and swift incident response are crucial in minimizing the impact of a data breach. Companies should invest in security information and event management (SIEM) systems and develop comprehensive incident response plans.

3. Transparency and Communication are Key

Open and transparent communication with affected individuals is essential in maintaining trust and mitigating the damage of a breach. Companies should promptly notify affected parties, provide clear and accurate information about the incident, and offer support and resources to help them protect themselves.

Protecting Yourself in the Wake of a Data Breach

If you believe your information may have been compromised in the First American data breach, here are some steps you can take to protect yourself:

- Monitor your financial accounts: Regularly review your bank statements, credit card bills, and other financial accounts for any suspicious activity.

- Place a fraud alert or credit freeze: Contact the major credit reporting agencies (Equifax, Experian, TransUnion) to place a fraud alert or credit freeze on your credit file. This will make it more difficult for someone to open new accounts in your name.

- Change your passwords: Update your passwords for all online accounts, especially those that contain sensitive information. Use strong, unique passwords for each account.

- Be wary of phishing scams: Be cautious of unsolicited emails, phone calls, or text messages that ask for your personal information. Cybercriminals often exploit data breaches to trick people into revealing sensitive data.

- Report identity theft: If you suspect that you are a victim of identity theft, report it to the Federal Trade Commission (FTC) and your local law enforcement agency.

Conclusion

The First American data breach serves as a sobering reminder of the ever-present threat of cybercrime and the importance of robust cybersecurity measures. Companies must prioritize data security and implement comprehensive strategies to protect sensitive information. For individuals, vigilance and proactive steps are crucial in safeguarding against identity theft and financial fraud. As technology continues to evolve, so too must our efforts to combat cyber threats and protect our digital lives.